how are rsus taxed in canada

When granted RSU is taxed as income. When vested the price difference is taxed as capital gain which count as 50 income.

Stock Options In Canada Are They Still Right For Your Executives Compensation Governance Partners

When the RSUs vest when youre able to sell them youll receive a taxable benefit equal to the value of the shares received or cash received.

. Taxable amount is fair market value of the shares on the tax event. RSAs are unpopular in Canada due to their tax treatment. Taxes must be withheld by your employer and remitted to the Canada Revenue Agency CRA.

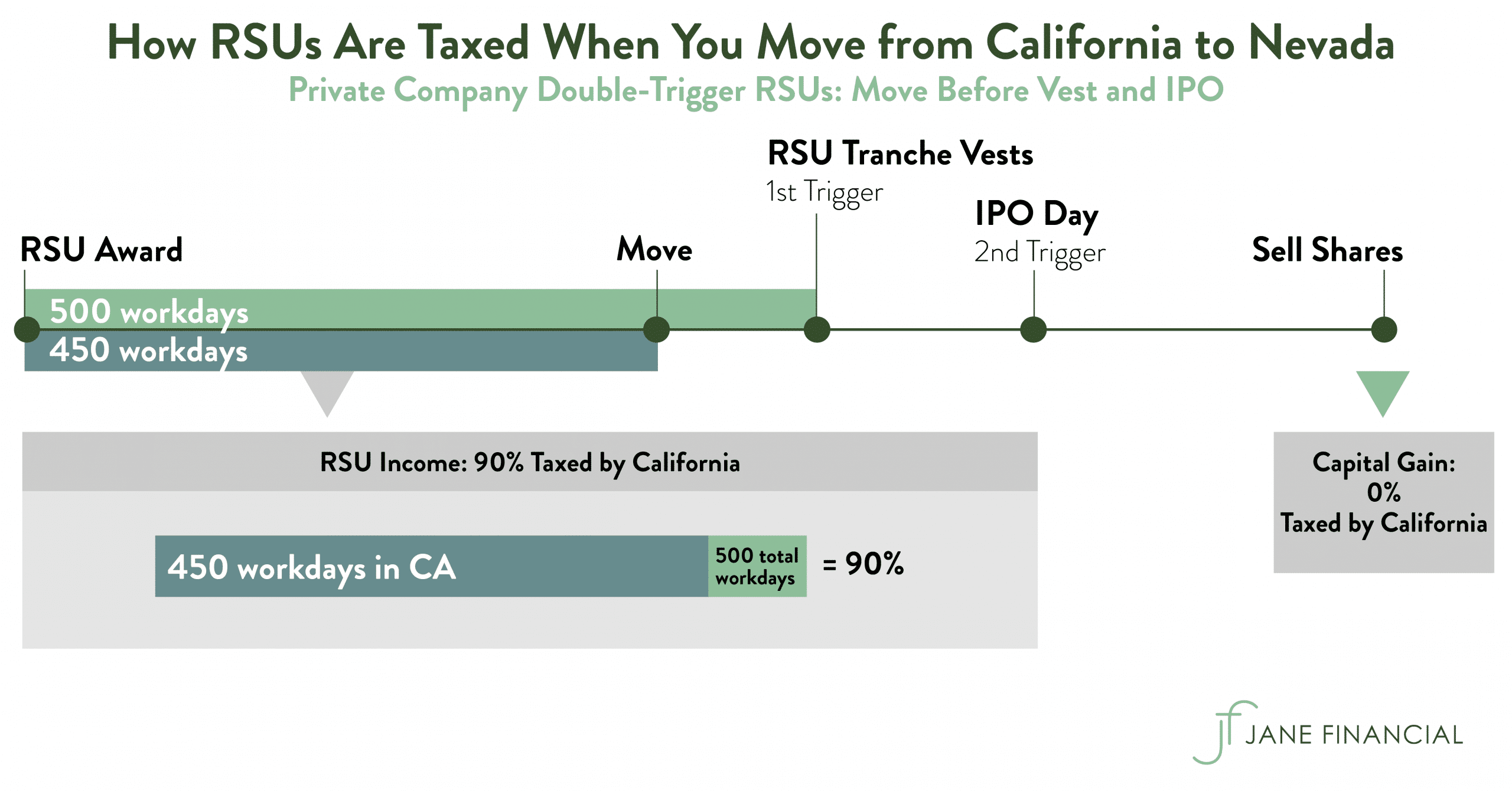

Restricted stock and RSUs are taxed as salaries and wages income upon vesting. Taxation of Employee - RSRSU. If you live in a state where you need to pay state.

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Generally tax at vesting for RSU. These awards can have adverse tax consequence and are rarely.

RSUs are taxed just like if you received a cash bonus on the vesting date and used that money to buy your companys stock. If the RSUs or PSUs are settled. The FMV of the the RSA grant is taxed as employment income at grant but employees will receive the cash from the.

If you receive an RSU when the stock is of little value you cannot elect to be taxed on the value of that stock when you receive the RSUyou pay taxes at vesting time based on. An RSU has little or no value until the vesting restrictions conditions have been achieved. How is employment income taxed.

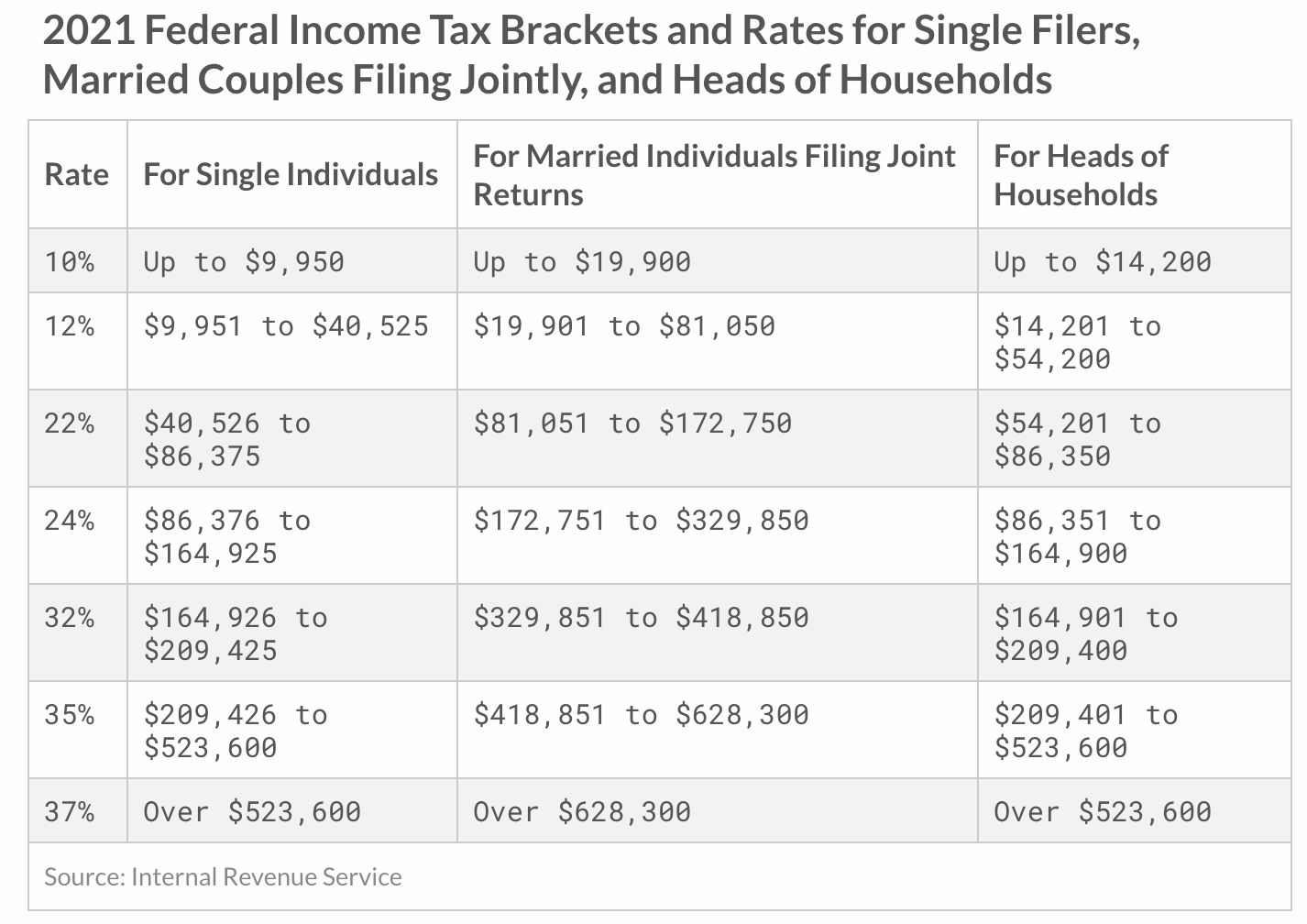

Capital gains tax is imposed upon the gains recognized from the sale of shares. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

The of shares vesting x price of shares Income taxed in the current year. For example your marginal tax rate is 30 you got. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs.

At the time the RSUs vest the employee is typically provided with shares and a. They are taxed as regular income upon vesting. This amount should be reported on your T4 from.

Tax at grant for RS. Canadian Tax Legal Alert CRA issues new views on RSU taxation in Canada April 21 2021 Contacts. As an example say you are awarded 100 in RSUs this translates into a certain number of units -.

RSU tax at vesting date is. Under the Income Tax Act ITA a taxpayers income from employment is all the compensation from employmentsalary wages and other. The year of receipt equal to the value of the RSUs or PSUs.

RSUs can trigger capital gains tax but only if the. Of shares vesting x. Also restricted stock units are subject.

If held beyond the vesting date the RSU tax when shares. Your RSU income is taxed only when you become fully vested in your shares. Remember that an RSU is technically nothing more than a promise that you will receive stock in.

613-751-6674 Chantal Baril Tel. Tax at vesting date is. Restricted Stock is issued to an employee subject to forfeiture if certain conditions are not met.

Thats why that taxes look so high.

How Are Rsus Taxed In California Quora

United States What Is The Purpose Of An Rsu Tax Offset Personal Finance Money Stack Exchange

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Restricted Stock Units Jane Financial

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Restricted Stock Units Jane Financial

Proposed Changes To Stock Option Taxation

How Do I Enter Restricted Stock Unit Rsu Sales In Turbotax Turbotax Support Video Youtube

Restricted Stock Units Jane Financial

Rsu Of Mnc Perquisite Tax Capital Gains Itr

Rsu Taxes Explained 4 Tax Strategies For 2022

The Blunt Bean Counter Punitive Income Tax Provisions

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted